The Food and Agriculture Organization of the United Nations (FAO) Vegetable Oil Price Index hits a multi-year high

The Food and Agriculture Organization of the United Nations (FAO) vegetable oil price index reached its highest level since April 2014 in November last year. This is due to the firmer prices of all vegetable oils, especially palm oil. At the same time, the oilseeds and oil meal indexes rose 10.6 and 10.3 points (or 9.9% and 9.8%) respectively, reaching their highest levels since mid-2014.

The index reflects the international price changes of the 10 most important vegetable oils in world trade. The average price index in November 2020 is 121.9 points.

The German Union for the Promotion of Fat and Protein Plants (UFOP) stated on December 9: "This means that the index has risen sharply by 15.4 percentage points, an increase of 14.5% from the previous month, which is the highest level since March 2014."

UFOP said the index came from rising palm oil prices, but soybean, rapeseed and sunflower oil prices also rose slightly in November.

According to data from agramarkt Informations Gesellschaft (mbH), due to the decline in production in major palm oil producing countries and strong global demand, global palm oil inventories have fallen sharply, and international palm oil prices climbed for the sixth consecutive month in November.

Soybean oil prices have also risen because of the decline in exports from South America and strong buyer interest, especially from India.

In addition, the prices of rapeseed oil and sunflower oil have risen due to limited supply, while all vegetable oil prices have benefited from the rise in international mineral oil prices, which has led to an increase in the price of biodiesel.

The recent increase in the oilseed index mainly reflects the higher value of soybeans, sunflower seeds and rapeseed. In November, international soybean prices rose for six consecutive months, reaching the highest point in six and a half years. In addition to reflecting people's continuing concerns about drought conditions in South America, prices also reflect several factors related to the United States. These include:

1) The lower-than-expected 2020 production estimate issued by the U.S. Department of Agriculture may reduce the U.S. food delivery inventory in 2020/21 to the lowest level in 7 years;

2) Due to the high margin of pressing, the pressing volume in October was higher than expected;

3) The record export commitment for 2020/21 reflects strong import demand, especially from China.

However, towards the end of November, the upward momentum in prices was somewhat curbed by rumors about Chinese importers canceling U.S. goods, because China’s processing profit margins have dropped significantly, and crushers may take advantage of the sufficient accumulation over the past few months. in stock.

As for sunflower seeds, international prices have soared to their highest level since March 2013 due to continuing concerns about weather-related production shortages in the Black Sea region. At the same time, international rapeseed prices have also risen sharply due to continued tight supply from the European Union (EU) and the decline in export availability due to strong demand from Canadian local crushers and exporters.

Regarding oil meal, the new increase in the FAO price index is related to the increase in soybean meal prices, and the price of sunflower meal has also increased. In November last year, international soybean meal prices rose for the fifth consecutive month, reaching a six-year high, due to tighter global supplies and stronger than expected feed demand in China. Similarly, due to crop failures, reduced export supplies from the Black Sea region, and a surge in Chinese purchases, the price of sunflower meal has risen.

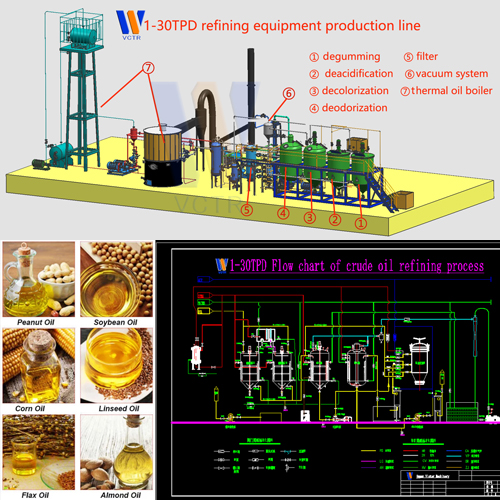

Chinese version of information sources: Oilsengineer. Compile: Henan Victor Machinery Equipment Co. , Ltd.